-

News

Tamil Nadu Parties Differ on Special Intensive Revision of Electoral Rolls

Tamil Nadu Parties Differ on Special Intensive Revision of Electoral Rolls

Oct 30, 2025, 01:05 IST

Prashant Kishore’s explosive claim: Big ‘murder’ charge on deputy CM Samrat Choudhary; warns of legal action

Prashant Kishore’s explosive claim: Big ‘murder’ charge on deputy CM Samrat Choudhary; warns of legal action

Sep 30, 2025, 18:03 ISTParis Police Arrest Two Suspects in €88 Million Louvre Crown Jewels Heist

Paris Police Arrest Two Suspects in €88 Million Louvre Crown Jewels Heist

Oct 28, 2025, 17:58 IST

Justice D.Y. Chandrachud Reflects on Ayodhya Verdict and Gyanvapi Case

Justice D.Y. Chandrachud Reflects on Ayodhya Verdict and Gyanvapi Case

Sep 27, 2025, 16:10 IST

Trump Repeats India-Pakistan Peace Claim, Cites 250% Tariff Threat

Trump Repeats India-Pakistan Peace Claim, Cites 250% Tariff Threat

Oct 30, 2025, 01:32 IST

Studies Link 1.5 Million Annual Deaths in India to Air Pollution

More Than 17 Lakh Deaths in India Linked to Air Pollution in 2022: Lancet Report

Oct 30, 2025, 01:43 IST

Tragic Bus Fire in Kurnool, Andhra Pradesh Claims 20 Lives, Sparks Nationwide Grief

Tragic Bus Fire in Kurnool, Andhra Pradesh Claims 20 Lives, Sparks Nationwide Grief

Oct 28, 2025, 12:46 IST

Ukraine’s Allies Tighten Oil Sanctions on Russia in Coordinated Push to Limit War Funding.

Ukraine’s Allies Tighten Oil Sanctions on Russia in Coordinated Push to Limit War Funding.

Oct 28, 2025, 11:51 IST -

World

Trump, Xi Reach Trade Breakthrough: U.S. to Cut Tariffs on China

Trump, Xi Reach Trade Breakthrough: U.S. to Cut Tariffs on China

Oct 30, 2025, 15:31 IST

Saudi Arabia sets clear rules for Content Creators and Influencers: Everything you need to know

Saudi Arabia sets clear rules for Content Creators and Influencers: Everything you need to know

Sep 30, 2025, 19:58 IST -

Business

Budget 2025 income tax: Personal tax announcements from the Budget and their impact

Budget 2025 income tax: Personal tax announcements from the Budget and their impact

Oct 1, 2025, 15:53 ISTTrump Trade Deal Hopes Propel Indian Markets: Sensex Jumps 300 Points, Nifty Tests 26,050

Metal equities are leading the way as investors on Dalal Street feel better about the US-India trade deal.

Oct 29, 2025, 18:19 IST -

Startup

-

Sports

One-hour drama in Dubai: Inside details of how PCB chief Mohsin Naqvi ran away with Asia Cup trophy after India vs Pakis

One-hour drama in Dubai: Inside details of how PCB chief Mohsin Naqvi ran away with Asia Cup trophy after India vs Pakis

Sep 29, 2025, 11:10 IST

India Beat Pakistan by 5 Wickets, Refuse Asia Cup Trophy

India Beat Pakistan by 5 Wickets, Refuse Asia Cup Trophy

Sep 29, 2025, 10:46 IST

Kartik Tyagi’s 150kph Pace Powers Meerut into UP T20 Final

Kartik Tyagi’s 150kph Pace Powers Meerut into UP T20 Final

Sep 27, 2025, 16:02 IST

Suryakumar Yadav and Haris Rauf Fined 30% Match Fee by Officials

Suryakumar Yadav and Haris Rauf Fined 30% Match Fee by Officials

Sep 27, 2025, 15:37 IST

India Escapes Narrowly Against Oman: A Match of Unforeseen Twists

India Survives Oman Scare: A Match Defined by Resilience and Grit

Sep 20, 2025, 13:27 IST

Afghanistan's Spin Attack Poses Challenge for Bangladesh in Asia Cup

Asia Cup 2025: Afghanistan's Spin Attack Challenges Bangladesh's Top Order

Sep 16, 2025, 17:48 IST- FIFA World Cup

- UEFA Champions League

- English Premier League

- La Liga

- Serie A

- Bundesliga

- Indian Super League

- Copa América

- African Cup of Nations

- Euro Cup

- UEFA Europa League

- FIFA Club World Cup

- Transfer News

- Player Profiles

- Team Rankings

- Managerial Changes

- Match Highlights

- Historic Rivalries

- Stadium & Venue Updates

Tanzania Wins First-Ever Gold as Simbu Triumphs in Marathon

Sep 15, 2025, 18:48 IST -

Entertainment

'Aaryan’ Explores the Dark Side of Morality in a Crime-Driven Thriller

'Aaryan’ Explores the Dark Side of Morality in a Crime-Driven Thriller

Oct 30, 2025, 15:58 IST

The Bengal Files Opens with Strong Performances but Struggles with Emotional Impact

The Bengal Files Opens with Strong Performances but Struggles with Emotional Impact

Sep 29, 2025, 18:55 IST

Nishaanchi Movie Review: A Bold Entry into Gangster Drama

Nishaanchi Movie Review: A Bold Entry into Gangster Drama

Sep 26, 2025, 20:06 IST

Jolly LLB 3 Review: Courtroom Humor, Justice & Drama

Jolly LLB 3 Review: Courtroom Humor, Justice & Drama

Sep 20, 2025, 18:19 IST

Asrani, Iconic Comedy Legend of Indian Cinema, Passes Away at 84

Asrani, Iconic Comedy Legend of Indian Cinema, Passes Away at 84

Oct 21, 2025, 11:13 IST -

Lifestyle

-

Healthcare

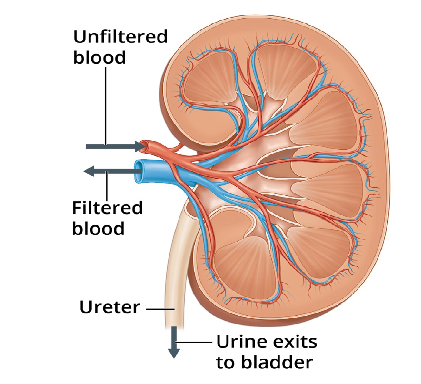

6 ‘healthy’ foods that may aggravate kidney stones

6 ‘healthy’ foods that may aggravate kidney stones

Oct 1, 2025, 16:18 IST -

Education

Gandhi Jayanti 2025: Speech and essay ideas for students

Gandhi Jayanti 2025: Speech and essay ideas for students

Oct 1, 2025, 16:33 IST

Markets showing resilience amid global uncertainty • Tech leaders call for AI regulation • Climate summit reaches historic agreement • New breakthrough in quantum computing announced • Sports: Championship final results

Markets showing resilience amid global uncertainty • Tech leaders call for AI regulation • Climate summit reaches historic agreement • New breakthrough in quantum computing announced • Sports: Championship final results

Markets showing resilience amid global uncertainty • Tech leaders call for AI regulation • Climate summit reaches historic agreement • New breakthrough in quantum computing announced • Sports: Championship final results

Markets showing resilience amid global uncertainty • Tech leaders call for AI regulation • Climate summit reaches historic agreement • New breakthrough in quantum computing announced • Sports: Championship final results

Markets showing resilience amid global uncertainty • Tech leaders call for AI regulation • Climate summit reaches historic agreement • New breakthrough in quantum computing announced • Sports: Championship final results

Markets showing resilience amid global uncertainty • Tech leaders call for AI regulation • Climate summit reaches historic agreement • New breakthrough in quantum computing announced • Sports: Championship final results

Markets showing resilience amid global uncertainty • Tech leaders call for AI regulation • Climate summit reaches historic agreement • New breakthrough in quantum computing announced • Sports: Championship final results

Markets showing resilience amid global uncertainty • Tech leaders call for AI regulation • Climate summit reaches historic agreement • New breakthrough in quantum computing announced • Sports: Championship final results

Markets showing resilience amid global uncertainty • Tech leaders call for AI regulation • Climate summit reaches historic agreement • New breakthrough in quantum computing announced • Sports: Championship final results

Markets showing resilience amid global uncertainty • Tech leaders call for AI regulation • Climate summit reaches historic agreement • New breakthrough in quantum computing announced • Sports: Championship final results

Markets showing resilience amid global uncertainty • Tech leaders call for AI regulation • Climate summit reaches historic agreement • New breakthrough in quantum computing announced • Sports: Championship final results

Markets showing resilience amid global uncertainty • Tech leaders call for AI regulation • Climate summit reaches historic agreement • New breakthrough in quantum computing announced • Sports: Championship final results

Markets showing resilience amid global uncertainty • Tech leaders call for AI regulation • Climate summit reaches historic agreement • New breakthrough in quantum computing announced • Sports: Championship final results

India vs England T20 World Cup 2025

‘Sikandar’ slowly inches toward Rs 110 crore in India

Leadership Strategies in a World of Uncertainty

Warmest April night in 3 years in Delhi, relief likely today

Pakistan

Pakistan

United Kingdom

United Kingdom

Europe

Europe

China

China

Middle East

Middle East